How to calculate lending capacity

Our bank as it is right now it has a reserve ratio of. Lenders generally follow a basic formula to calculate your borrowing capacity.

How Much Mortgage Can I Afford Increase Borrowing Power

Lock Your Mortgage Rate Today.

. The amount of Income you make each month 12. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Thus as part of calculating your borrowing capacity it is also wise to ask your lender what is going to be the interest rate for your loan.

APPLY FOR LOAN APPLY FOR LOAN. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. View your borrowing capacity and estimated home loan repayments.

Estimate how much you can borrow for your home loan using our borrowing power calculator. So the bank has to stay liquid. A bank loan implies interest rates that can make your investment even more expensive than it is.

Multiple the monthly income by 12 to get a notional yearly income Percent Interest Per. A business takes on debt for several reasons. Suppose for example that you were comparing.

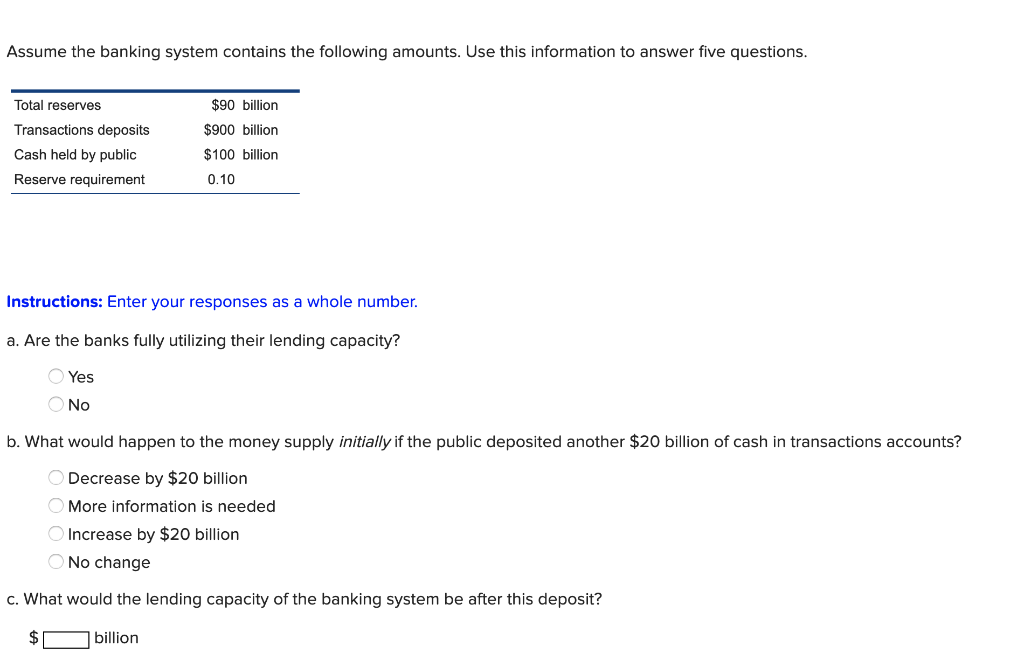

Your borrowing capacity is calculated by adding your gross income deposit size and credit score. So essentially this reserve ratio is what the regulators think that a bank needs to maintain in order to be liquid. While there is a standard formula lenders follow lenders may assess your income or expenses.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Unused lending capacity Formula. The calculators max loan amount is NOK 15 000 000.

Your borrowing capacity is the maximum amount lenders will loan to you. Get Your Estimate Today. Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score.

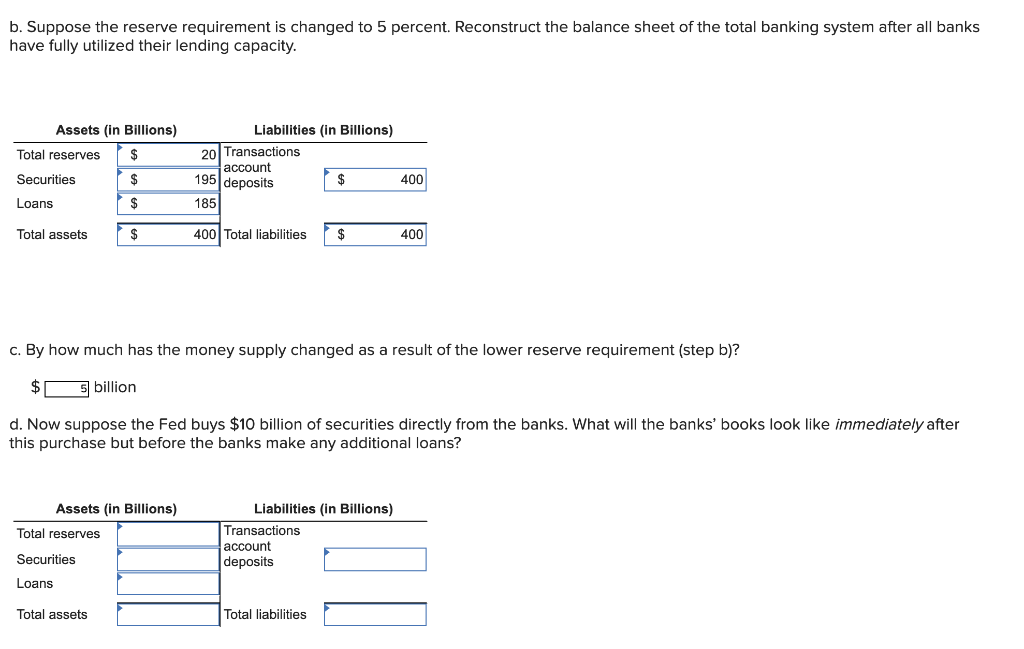

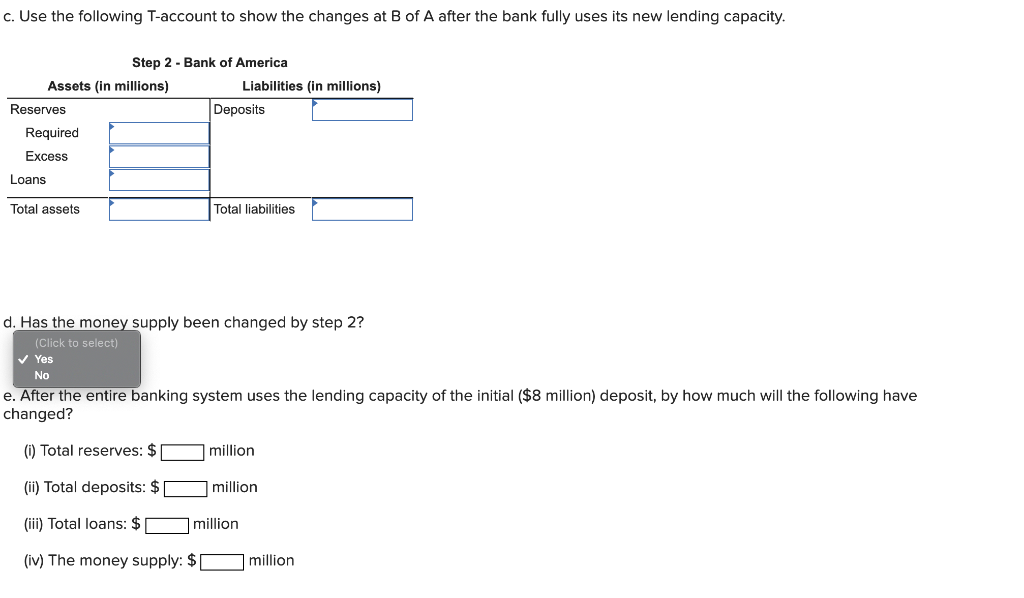

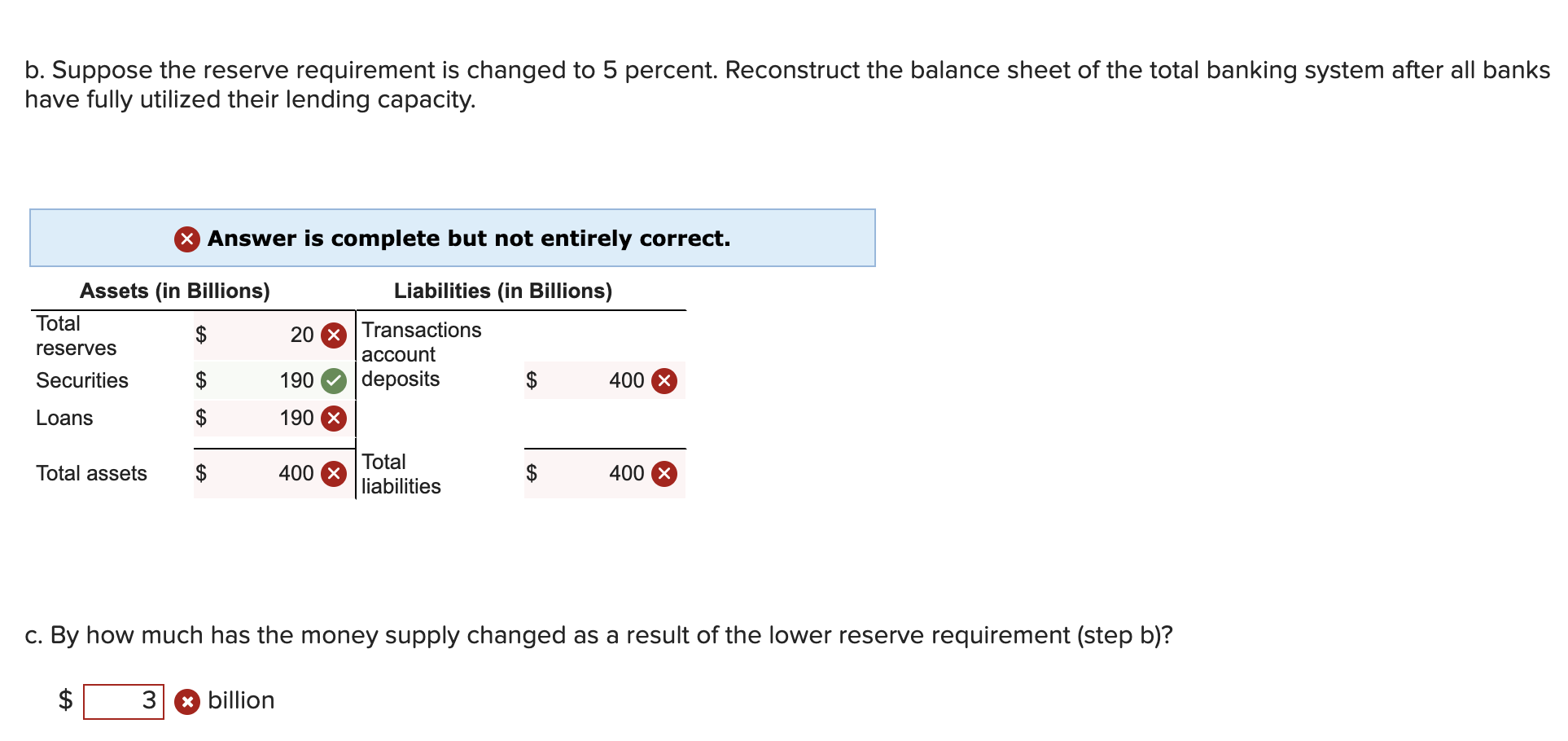

Therefore you have to relate your personal revenue. Available lending capacity excess reserves X money multiplier Increasing the reserve requirement means o Amount of excess reserves decreases o Money multiplier decreases o. Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP.

How to calculate Loan Capacity Total Income. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Compare home buying options today.

Get The Service You Deserve With The Mortgage Lender You Trust. Estimate how much you can borrow for your home loan using our borrowing power calculator. Ad Were Americas Largest Mortgage Lender.

Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus. Apply if approved a business line of credit is ready whenever you need it. Total reserves - required reserves.

Different lenders require different. Lenders generally follow a basic formula to calculate your borrowing capacity. To calculate the loan amount as accurately as possible you will need to enter the monthly repayment you want the duration of the loan and the interest rate of the loan.

The lender wants to know how much you. Ad Apply and if approved Use Business Funding Today Tomorrow Anytime. Your expenses and other debts count against you.

Assessing Debt Capacity The two main measures to assess a companys debt. 1 required reserve ratio. Debt capacity refers to the total amount of debt a business can incur and repay according to the terms of a debt agreement.

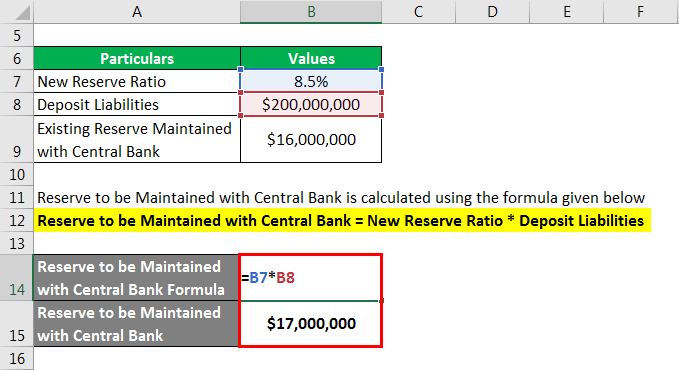

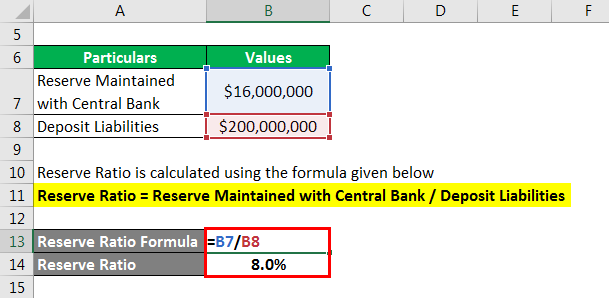

Required reserve ratio x total deposits. Buying or investing in. The mortgage calculator will take this information and display a graph detailing the amount of interest you will pay to each potential lender.

Understanding Coverage Ratio A Measure Of The Ability To Repay Loans Farmdoc Daily

Reserve Ratio Formula Calculator Example With Excel Template

Money Creation Yellow Page Worksheet

Understanding Coverage Ratio A Measure Of The Ability To Repay Loans Farmdoc Daily

Reserve Ratio Formula Calculator Example With Excel Template

Solved I Need The Answers And Explanations Of The Chegg Com

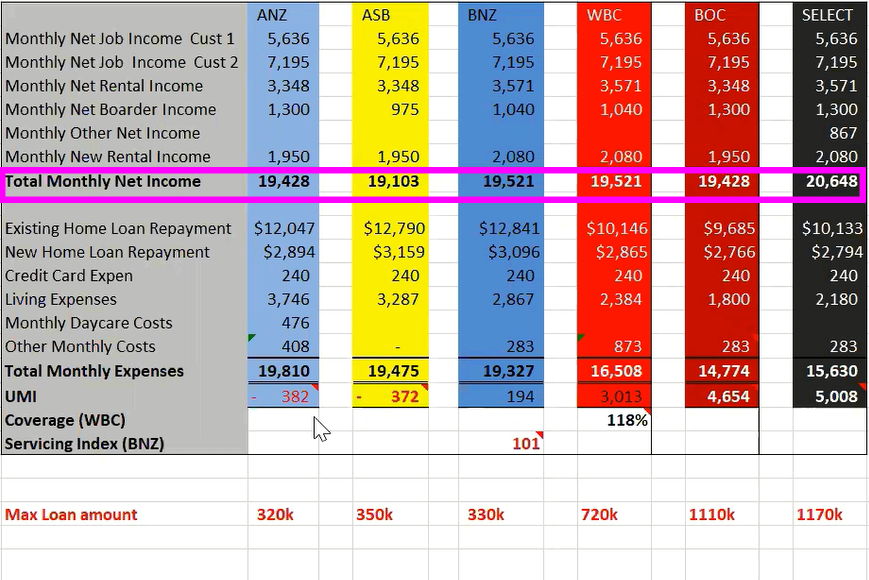

Lvr Borrowing Capacity Calculator Interest Co Nz

Money Banking And Financial Institutions Ppt Video Online Download

How Much Can I Borrow Home Loan Calculator

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Solved Please Give Me An Explanation Of The Calculations Chegg Com

Borrowing Capacity Explained Your Mortgage

What Is Asset Based Lending Who Qualifies

Solved Can You Give The Explanations Of The Calculations Chegg Com

Solved I Need The Correct Answers And Explanations Of How To Chegg Com

2